2025 Hiring Trends: When Companies Actually Hire (Research Report)

A Research Report for HR & Talent Leaders on the Busiest Times of Year for Hiring

Executive Summary: When Companies Hired Most in 2025

Based on an analysis of three years of pre-hire assessment data, Cangrade’s research reveals that traditional hiring seasonality has evolved into a more balanced, strategic approach we’re calling the “precision era.”

Key Findings:

- Tuesday-Wednesday: Busiest hiring days (18.4% and 18.3% respectively)

- September: Peak hiring month (12.1% of annual volume)

- Q3 (Jul-Sep): Strongest quarter for hiring employees (28.1% of activity)

This represents a fundamental shift from traditional January-focused hiring cycles to a more distributed, needs-driven approach.

Hiring in a “Precision Era”

For years, HR leaders relied on familiar rhythms: January job booms, midweek hiring spikes, and predictable seasonal surges. But in the years following COVID, these patterns unraveled. Remote work reshaped candidate behavior, economic uncertainty reshaped employer planning, and a new era of selective, skills-focused hiring emerged.

Cangrade’s analyses over the past three years reveal a labor market that has transitioned from turbulent to intentional. Hiring hasn’t slowed to a stop. But it has become more strategic, more distributed across the calendar, and far more dependent on data-driven decision-making.

In 2025, U.S. employers announced over 1.17 million job cuts through November, the most since 2020, while planned hiring fell 35% year-over-year, reaching its lowest level since 2010. This combination has led to what economists are calling a “no fire, no hire” labor market. Companies are reluctant to expand headcount, but they’re also reluctant to cut deeply unless necessary.

Against that backdrop, understanding when and why hiring actually happens has never been more valuable.

This report provides:

- A clear picture of 2025 hiring activity based on Cangrade assessment data

- How these patterns evolved from 2023 to 2024 to 2025

- The economic realities reflected in hiring behavior

- What it all means for HR leaders planning for 2026

- Tactical recommendations to strengthen your hiring strategy

Cangrade’s position at the front end of the hiring funnel, where assessments are completed early in the process, gives us a uniquely accurate view into real-time hiring activity across industries and roles.

Methodology: How We Analyzed 2025 Hiring Trends

This analysis uses hundreds of thousands of Cangrade Pre-Hire Assessment completions from 2025, compared to equivalent datasets from 2023 and 2024.

Why assessment completions?

- They typically occur immediately after application or early screening

- They represent a consistent, scalable indicator of active hiring volume

- They capture cross-industry behavior at a level not visible through traditional job-posting analytics

To ensure a realistic view of typical hiring behavior, we removed one anomaly in our data associated with a one-off, large client event that exceeded ordinary hiring demand. No other manipulations were made to the dataset. Final observed volumes were used.

The 2025 Hiring Landscape: More Even, More Strategic, More Predictable

If 2023 was chaotic and 2024 was stabilizing, 2025 was the year hiring settled into a new, more balanced rhythm.

What Is the Best Month to Hire Employees?

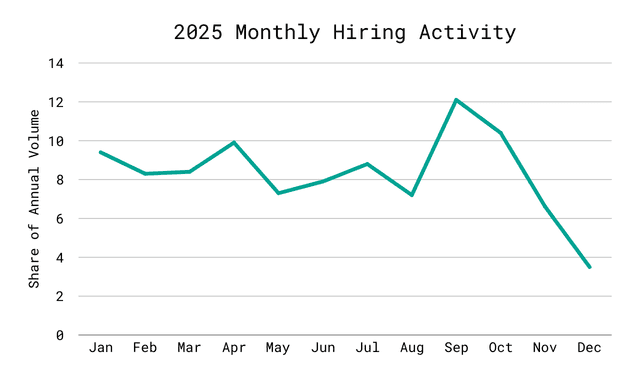

Rather than surging in a single “hot month,” hiring activity in 2025 flowed steadily from Q1 through Q3, with a meaningful, but not extreme, seasonal lift in early fall.

September 2025 was the busiest hiring month, accounting for 12.1% of annual hiring activity. This represents a shift from traditional January-focused hiring cycles.

The Four Months That Shaped 2025 Hiring

Each of these months contributed significantly to annual hiring volume:

- September: Peak hiring month (12.1%)

- Post-summer business ramp-up

- Annual planning cycles

- Budget refreshes

- Front-loading of hiring ahead of Q4 slowdowns

- October: Strong early-fall continuation (10.4%)

- Sustained momentum from September

- Year-end hiring push

- April: Spring renewal (9.9%)

- Post-Q1 planning execution

- New budget activation

- January: Active start (9.4%)

- More active than recent years, but no longer dominant

What’s notable is not the peaks themselves, but the absence of extreme spikes. No single month exceeded ~12% of annual hiring volume. This indicates predictable, year-round hiring, rather than large-scale surges concentrated in summer or early Q2.

This shift is consistent with broader economic trends:

- As job cuts rose in 2025, employers became more careful with new requisitions.

- Hiring became more needs-driven, less season-driven.

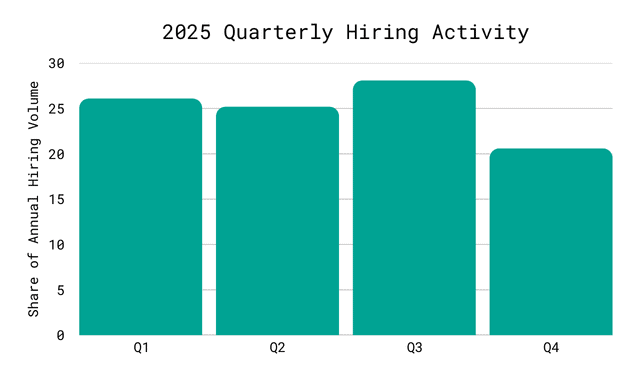

When Do Companies Hire Most? A Quarterly Breakdown

Q3 (July-September) was the strongest quarter, accounting for 28.1% of annual hiring activity, but the distribution across quarters shows remarkable balance. Q1 and Q2 were nearly tied with Q3, and while Q4 remained the softest quarter, it still accounted for meaningful hiring activity.

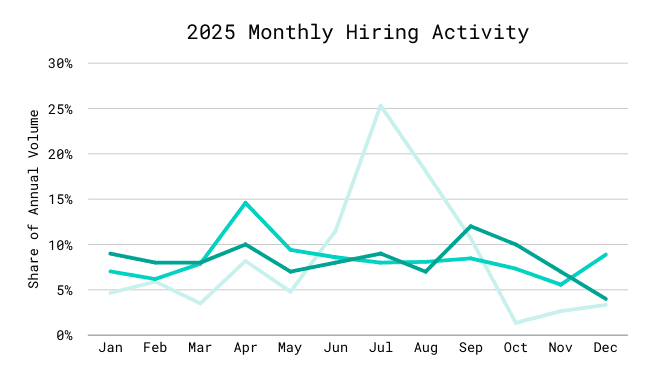

This distribution indicates a return to operational steadiness. Unlike 2023, where July alone accounted for 25% of assessment completions, 2025 shows none of that volatility. Hiring now follows business needs more than traditional seasonality.

Companies are not “waiting for January” or “rushing in July.” They are hiring as roles become essential. Not before, not after.

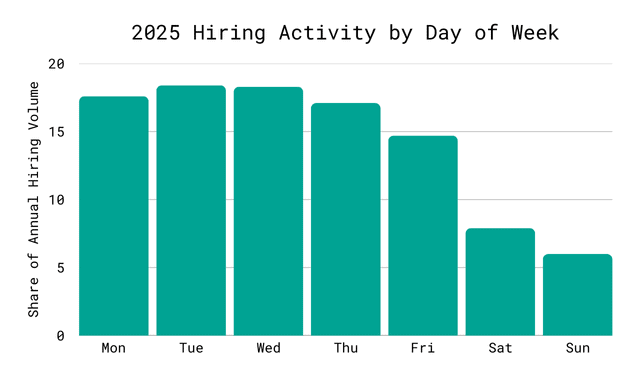

Best Days of the Week to Hire Employees

In 2025, Tuesday and Wednesday were the busiest hiring days. But the difference is marginal. The real story is the consistent Monday-Thursday hiring band.

2025 Day-of-Week Breakdown

| Day | % of Weekly Hiring | Hiring Pattern |

|---|---|---|

| Tuesday | 18.4% | Slight peak |

| Wednesday | 18.3% | Slight peak |

| Monday | 17.6% | Consistent activity |

| Thursday | 17.1% | Consistent activity |

| Friday | 14.7% | Active but lighter |

| Saturday | 7.9% | Slower weekend activity |

| Sunday | 6.0% | Lowest volume |

This reflects modern candidate behavior:

- Candidates often explore roles on weekends

- They apply and complete assessments during the workweek, when hiring managers are responsive

- Companies with automated hiring workflows create smoother weekday throughput

As hiring becomes more continuous and more technology-driven, the midweek spike has flattened into a steady weekday cadence.

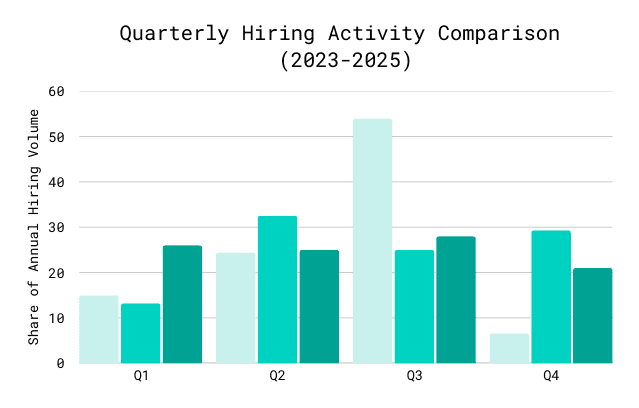

Year-Over-Year Trends: How Hiring Patterns Changed from 2023 to 2025

Cangrade’s data shows a clear evolution across three years.

2023: A year of volatility

The hiring pattern:

- July spiked to 25% of annual hiring activity

- October hit an all-time low at 1%

- Q3 carried more than half of all hiring

- Tuesday dominated weekdays

The economic context: 2023 marked the first national decline in job openings and hires since 2009, according to the U.S. Bureau of Labor Statistics JOLTS report.

2024: A year of stabilization

The hiring pattern:

- Most months clustered between 7% and 9%

- April peaked at 14.6%, but no extreme outliers

- Q2 grew in importance

- Monday and Wednesday overtook Tuesday as the busiest days

- Sunday activity rose meaningfully

The economic context: U.S. unemployment remained near 4%, supported by broad labor-market resilience as reported by the BLS.

2025: A year of balance and precision

The hiring pattern:

- Hiring spread evenly across Q1–Q3

- September led, but moderately

- Weekday hiring was steady Monday–Thursday

- Hiring frequency reflected economic caution, not operational delays

The economic context: With 1.17 million job cuts announced through November (the most since 2020) and planned hiring down 35% year-over-year, 2025 reflected a “no fire, no hire” labor market where companies made fewer but more strategic hiring decisions.

This three-year shift shows a maturing hiring environment. The market moved from reactive to stabilized to strategic. Instead of reacting to shocks (2020–2022) or scrambling during tight labor periods (2023), employers in 2025 made fewer but more deliberate hiring decisions. Exactly what you would expect in a cautious, restructuring-heavy economy.

What These Trends Mean for HR Leaders

The most important insight for HR teams is not the busiest month or day. It’s the new hiring philosophy revealed in the data.

1. Hiring is now year-round

Relying on traditional “busy seasons” is no longer effective. Managers open roles whenever work requires it, and candidates move through pipelines continuously.

HR takeaway: Adopt always-on pipelines and sourcing strategies that can flex to year-round demand.

2. Q3 is not a spike – it’s a sustained period of demand

September’s prominence does not come from surge hiring, but from consistent fall hiring momentum.

HR takeaway: Prepare ahead for increased volume from August through October by stabilizing processes early in the year. Especially for roles tied to annual planning, customer cycles, and education calendars.

3. Weekday consistency requires process consistency

Steady Monday through Thursday hiring means recruiting teams need systems and predictable internal workflows, not sprint cycles.

HR takeaway: Create repeatable weekly workflows, like:

- Monday: Assessment review

- Tuesday–Wednesday: Interviewing

- Thursday: Decision-making

- Friday: Pipeline clean-up and next-week planning

4. Slow quarters are your strategic advantage

Q4 remains quieter, but not stagnant, and Q1 is more about planning than hiring.

HR takeaway: Use these slower hiring windows for:

- Talent strategy and headcount planning

- Process redesign

- Assessment calibration

- Hiring manager training

- Implementation of new tools and workflows

Strategic Hiring Calendar Predictions for 2026: What’s Ahead & How HR Should Prepare

Based on three years of Cangrade data and current economic indicators, 2026 is expected to continue many of the precision-hiring patterns established in 2025.

Prediction 1: Hiring volume will remain steady but conservative

With planned hires at their lowest levels since 2010, companies will continue practicing “precision hiring” with fewer requisitions, but more pressure to get each one right.

What HR should do:

- Invest in skills-based hiring and validated assessments

- Focus on quality and efficiency over expansion

- Support hiring managers with clear decision frameworks

Prediction 2: Q2 and Q3 will continue to lead hiring activity

Spring and fall have emerged as consistently strong periods.

What HR should do:

- Finalize hiring plans and competencies by the end of Q1

- Ensure assessment workflows and interview processes are fully optimized before mid-year

- Prepare capacity (recruiting bandwidth, interview availability) for steady demand, not one-off spikes

Prediction 3: The weekday pattern will remain stable

Monday through Thursday hiring will continue to carry the majority of hiring activity, with Tuesday and Wednesday slightly elevated.

What HR should do:

- Time assessment invitations early in the week

- Concentrate interviews midweek for faster turnaround

- Use automation to move weekend applicants quickly on Monday

Prediction 4: Skills-based and AI-supported hiring will accelerate

Lean teams and increased pressure will drive HR teams to adopt tools that improve hiring quality and efficiency without increasing headcount. Research across the industry shows organizations are increasingly turning to assessments, structured interviews, and AI-enabled tools to make better, faster hiring decisions.

What HR should do:

- Adopt or expand skills-based hiring frameworks

- Use assessments early to reduce noise in applicant pools

- Leverage AI recruiting tools, like resume screeners and video interviewing, with transparent, validated methodologies

Prediction 5: Q4 and early Q1 will remain strategic, not high-volume, periods

These windows are critical for planning, calibration, and enablement rather than high-volume recruiting.

What HR should do:

- Conduct funnel audits

- Calibrate assessments and interview guides

- Identify and optimize processes

- Align hiring forecasts with finance and executive leadership

- Train hiring managers on evaluation consistency and bias mitigation

The Future Belongs to the Prepared

The hiring calendar is no longer driven by tradition or assumption. Hiring today is smoother, more predictable, and more intentional. It’s driven by business needs, candidate behavior, and a market that values precision over volume.

The HR teams that thrive in 2026’s precision-era hiring will be those that:

- Maintain always-on, skills-based pipelines

- Build consistent weekly rhythms

- Leverage data and assessments to make confident decisions

- Use slower periods to sharpen their talent strategies

Take Action: Optimize Your 2026 Hiring Strategy

In a world where every hire matters more, insight becomes a competitive advantage. Discover how Cangrade can help your team make better, faster, and more equitable decisions whenever hiring happens.

Frequently Asked Questions About Hiring Timing

What is the best time of year to hire employees?

September through October is the busiest hiring window, with Q3 overall representing 28.1% of annual hiring activity in 2025. September specifically accounted for 12.1% of annual volume, the highest of any single month.

However, 2025 data shows hiring has become more evenly distributed year-round. No single month exceeded 12% of volume, indicating that companies now hire based on business needs rather than traditional seasonal patterns.

Is there a best day of the week to hire?

Tuesday and Wednesday show slight peaks (18.4% and 18.3% respectively), but the key insight is that Monday-Thursday form a consistent hiring band, with each day accounting for 17-18% of weekly activity.

The traditional “post jobs on Tuesday” advice has evolved. Modern hiring is continuous throughout the weekday, driven by automated workflows and year-round candidate activity.

When should I start recruiting for Q3 positions?

Begin Q3 recruiting campaigns by early July to capitalize on the strongest hiring quarter. Since Q3 represents 28.1% of annual activity, ensure your:

- Recruiting team has the capacity for sustained (not spike) demand

- Assessment workflows are optimized by the end of Q2

- Interview processes are streamlined

Has hiring seasonality changed since COVID?

Yes, dramatically. 2025 data shows:

- More even distribution across quarters (Q1-Q3 within 3 percentage points of each other)

- No extreme monthly spikes (unlike 2023’s 25% July surge)

- Shift from Tuesday-only peak to Monday-Thursday consistency

- Year-round hiring is replacing traditional January-focused cycles

This reflects what we call the “precision era”: strategic, needs-driven hiring over traditional seasonal patterns.

What is the worst time to hire?

Q4 (October-December) is the quietest hiring period, representing 20.6% of annual activity. However, this isn’t necessarily “bad.” It’s an opportunity for:

- Strategic planning and process optimization

- Assessment calibration and tool implementation

- Hiring manager training

- Preparing for Q1-Q3 demand

Many companies also use late Q4 to post positions with January start dates.

When do companies hire the most in the spring?

April shows the strongest spring hiring, accounting for 9.9% of annual volume. Spring (Q2) overall represents 25.2% of annual hiring, nearly tied with Q1 and Q3.

Is January still a peak hiring month?

January remains active (9.4% of annual volume) but is no longer the dominant hiring month it once was. September has overtaken January as the peak hiring period, reflecting a shift from traditional calendar-driven hiring to more strategic, business-needs-driven recruitment.